All posts by admin

Posted on 10 June, 2018, No Comments Comments admin

I re-read T.R. Andhyarujina’s masterpiece “The Kesavananda Bharati Case – the Untold Story of Struggle for Supremacy by Supreme Court and Parliament” (Pub.2011). To this I have added my reading of a series of essays written by various authors and edited by Arghya Sengupta and Ritwika Sharma titled “Appointment of Judges to the Supreme Court of India – Transparency, Accountability and Independence” (Pub. April, 2018). The two publications contain several facts, supported by pre-published material, which were known to several senior colleagues in the legal profession.This ought to be shared with a larger constituency.

The Nehruvian Era

Justice H.J. Kania took over as the first Indian Chief Justice of the Federal Court – the pre-constitution predecessor of the Supreme Court. When Justice Kania started recommending names for appointment to the High Courts, it caused a significant flutter. Pt. Nehru questioned his suitability to be the first Chief Justice of India. It was only Patel’s pragmatism that had enabled him to “manage” Justice Kania.

There is a reference to contemporaneous correspondence. Two letters of Sardar Patel – one to Pt. Nehru dated 23.1.1950 and yet another letter dated 12.11.1950, which substantiates this.

Justice Bachu Jagannadha Das made it to the Supreme Court because of his strong Congress Party connections. He had fought an election and served in the Madras Corporation. His case was strongly recommended by Dr. Rajendra Prasad, Shri V.V. Giri, who was then India’s High Commissioner in Colombo and the Orissa Chief Minister Shri H.K. Mahtab, who in writing recommended that “My friend Jagannadha Das be recognised for his seniority and be appointed to the Court”. Such political recommendations are today unthinkable.

Indira Gandhi Era

Chief Justice Hidayatullah recommended the names of Justice S.P. Kotwal, the Chief Justice of Bombay; Justice M.S. Menon, Chief Justice of Kerala to the Supreme Court. The executive did not respond to either of the two names and ignored the recommendations. The Chief Justice meekly submitted and never questioned the inaction.

An important turn in the judicial appointments history was the decision of the Prime Minister to appoint ideologically committed Law Ministers so that judicial appointments could be influenced by the social and political philosophy of the judge. The duo of Law Minister H.R. Gokhale and the Steel and Mines Minister, Mohan Kumaramangalam, took charge and on theirpriority was the need to reverse the decision of the Supreme Court in Golaknath case. Golaknath had read into the Constitution amending power of Parliament an implied restriction so that democracy itself can’t be tampered with. The senior judges of the Supreme Court included one of whom was a part of the majority opinion in the Golaknath case and some others had expressed their opinions in the bank nationalisation and privy purses against the Government. To change the arithmetic, the future judges had to follow the social and political philosophy of the Government. “Never before could any of the Judges who were to be seen to have a primary political sponsor, it had to be accepted that the appointments were initiated by the Chief Justice to the Law Minister. Law Minister H.R. Gokhale initiated the appointment of his Bombay High Court colleagues D.G. Palekar, Y.V. Chandrachud, Sidhartha Shankar Ray recommended Subimal Chandra Ray and A.K. Mukherjee; Mohan Kumaramangalam recommended K.K. Mathew, C Subramaniam recommended his classmate Alagiriswamy and Indira Gandhi herself recommended Mirza Hameedullah Beg and Surendra Narayan Dwivedi from family’s home town, Allahabad.” The author cites in support the views of Judges P. Jaganmohan Reddy and A.N. Grover – the then sitting judges. This was a pre-preparation for changing the numbers equation in the Kesavanand Bharati case which had to sit in review of the Golaknath case. Needless to say that many of the above who were on the bench were part of the pro-Government minority opinion in the Kesavananda Bharati case.

Kesavananda Bharati Case

It goes to Andhyarjuna’s credit that having appeared with H.M. Seervai on the Government side, he has authored a brilliant and accurate day by day history of how the Kesavananda case proceeded. There was acrimony on the bench. The citizen was represented by none other than Nani Palkhiwala and the Government by H.M. Seervai with supporting arguments from Attorney General Niren De. When a judge asked counsel a question, someone with an alternate opinion on the bench would answer it. It was a thirteen Judge Bench and the obvious object of both sides in a dividing bench was to reach the figure of 7 for the law to be laid down. There are several interesting episodes which need to be stated.

When opinion seem to be swinging in favour of the citizen, there were worries on the Government side. Chief Justice Sikri was to retire after the hearing and delivering of the judgement. There were only few weeks left to his retirement. The hearing had to be concluded, the judgement has to be written and delivered before his retirement day. The Government was keen that the case should not conclude till Justice Sikri’s retirement. It had already planned that on the day of Justice Sikri’s retirement, Justice Shelat, Justice Grover and Justice Hegde would be superseded. This will completely change the arithmetic of the bench. The bench, particularly the Chief Justice, was determined not to adjourn the case. Justice M.H. Beg got admitted to the All India Institute of Medical Sciences. The bench adjourned up for the week hoping that it would come back by Monday. The Chief Justice held a meeting and decided that Justice Beg was unable to come back and remaining twelve judges would hear the case. The bench would stand reconstituted. Justice Beg did come back but after the arguments of the State had been completed and Palkhiwala was giving the rejoinder with two days of the rejoinder left, Justice Beg went back to the hospital once again. The hospitalisation of Justice Beg took place thrice. The bench again adjourned the hearing. Uncomfortable with the situation the Chief Justice went personally to the All India Institute of Medical Sciences ostensibly to inquire if it was a serious ailment. He was informed by the doctors that they had advised Justice Beg rest for an indefinite period of time. To his query as to what was the seriousness of the ailment, he was told that it was a case of “High blood pressure”. The Chief Justice again called the lawyers and the judges and had meetings to find a solution. He suggested that the balance twelve judges would hear the case in the next two days, complete the arguments and reserve the judgement. To a suggestion that the case could be heard without Justice Beg, the Attorney General said that in that event I shall walk out. Surprisingly, Seervai also threatened to walk out. The remaining judges assembled the next day to pronounce the order but Palkhiwala saved the situation and said his arguments stood concluded, the judgement could be reserved and what he had to argue over the next two days, he would submit in writing. The judgement stood reserved.

The lawyers appearing on the citizens side had identified who the pro-Government judges were. In fact one of them, Justice Dwivedi, stunned everyone when he told Palkhiwala in open court that if you are willing to procure from the Parliament that the other fundamental rights were unamendable if he were to concede that the Right to Property is not a fundamental right.

Finally came the judgement day. Six judges held that fundamental rights were unamendable. There was an implied limitation on the power of Parliament to amend. Six others held that Parliament had power to amend every Article of the Constitution. The thirteenth judge H.R. Khanna held that the implied limitation on the power to amend was in relation to the basic structure of the constitution. The opinion of one judge thus became the law. After the judgement had been read and the Chief Justice read out the final order with regard to the law declared by the Supreme Court and then signed the same, he circulated it to the bench for signatures. Four of the dissenting judges – Ray, Beg, Mathew and Dwivedi refused to sign the order. The Kesavananda Bharati’s final order is signed by only nine of the thirteen judges. That very day Shelat, Grover and Hegde were superseded and A.N.Ray become the new Chief Justice. Upon Ray’s retirement, Khanna was superseded and Beg became the Chief Justice.

The Present Context

Times moved on and through a series of judicial pronouncements the court started diluting the role of executive in judicial appointments. The Constitution envisages an important role for the executive. It is a part of the democratic accountability. Past experiences perhaps weighed with the court in diluting the role of the executive in judicial appointments. The executive can give inputs, it can even refer a recommendation back with relevant inputs for reconsideration but is eventually bound by the recommendations. This is contrary to the text of the Constitution. The hue and cry made by my friends in the Congress Party recently when the Government referred a case back for reconsideration, fades into the oblivion. It is part of the much diluted role of an elected Government that relevant inputs be brought to the notice of the collegium. This is consonance with democratic accountability. All must know this important chapter of history.

I have written this blog so that my friends in the Congress party get an opportunity to look at the mirror.

Posted on 08 June, 2018, No Comments Comments admin

Post 1991 economic liberalisation, there has been a phenomenal growth in the creation of new townships, urbanisation and more particularly sub-urbanisation. This trend is likely to accelerate. Economic growth gives rise to aspirations. More purchasing power, migration from rural areas and aspiration to improve the quality of life are increasing. In and around major townships massive real estate projects have been coming up. Many of these are by professional real estate developers. This is also an area where many “fly by night” operators have entered. Some developers have very little resources of their own. They use the homebuyer’s money to develop, invest in land banks and then get caught in debt trap. The homebuyer is the worst sufferer. He has a triple whammy. He has invested his savings with the developer. He may be paying EMIs on the loans taken and may continue to pay either rent of his currently occupied property or live in some alternate accommodation under compulsion.

The new ordinance equates an “allottee” of a “real estate project” to be a person having a commercial effect of borrowing. He is now treated as financial creditor. He can initiate a corporate insolvency for a resolution against the errant developer. He acquires the right to be on the committee of creditors. He gets voting right. He can influence the resolution process. In the unlikely eventuality of liquidation, he stands at par with other financial creditors.

Given his logistical problems, liquidations are rarely likely to take place in asset owning companies. Resolution is the natural course. In a resolution probably some other developer would acquire an interest or some alternative method found of completing the project. The inevitable consequence of this would be that the market itself will discover solutions. Just as the film industry, in the last few years, has increasingly formalised itself, the real estate industry would eventually will have to formalise itself. Sound and structured real estate developers would remain. The “fly by night” operators would be eliminated. Projects would be completed in reasonable time and investors would get their share of allotments expeditiously. Construction is already growing at a double digit growth. RERA and the new ordinance would only catalyse this process further.

—————————————————————————————————————————————–

Increased Maoist Activities

The past few days have witnessed evidence of increased Maoist activities in areas other than usual extremism affected areas. This is a dangerous tendency which all political parties must realise and react to. The Maoist believe in the violent overthrow of constitutional system and not just the Government. In their perceived system there are no fundamental rights, no rule of law, no Parliament and no free speech. But to expand their political base their sympathisers make full use of the democratic idioms.

Whilst in the opposition during the UPA II, I had analysed in Rajya Sabha that there are four kinds of Maoist in India. Firstly, those who ideologically indoctrinate. The second category is the weaponised Maoist who carry out the operations. The third category is innocent tribals or others who face injustice, who have been misled to believe that Maoist will get them relief. We seriously need to address this section. The fourth category is what I have always called “half Maoist”. Willingly or otherwise, they become over-ground face of the underground. They are a part of the democratic system. They masquerade as activist; they speak the language of democracy; they have captured the human rights movement in several parts of the country but always lend support to the Maoist cause. They are unwilling to condemn. Unfortunately some political parties see the Maoist as their instrument in the anti-NDA cause. The history of terrorism and extremism teaches us one basic fact. Never ride a tiger, you may be its first victim.

Posted on 06 June, 2018, No Comments Comments admin

Every time I listen to the view of Shri Rahul Gandhi, both inside and outside Parliament, I ask myself the same question – How much does he know? When will he know? Listening to his speech delivered in Madhya Pradesh today reaffirms my curiosity about the answer. Is he being inadequately briefed or is he being a little too liberal with his facts. I take for consideration the six basic points that he made in the speech today:

1). He accused Prime Minister Modi of waiving of the loans of Rs.2.5 lakh crores of the 15 top industrialists in the country. – Factually this is completely false.

The Government has not waived of a single rupee due from any industrialist. The facts are to the contrary. Those who owed money to the banks and other creditors have been declared insolvent and removed from their companies by IBC enacted by Prime Minister Modi’s Government. These loans were given largely during the UPA Government.

2). Loans are not available to the kisans but only to the industrialists- Factually false.

This was during the UPA Government, particularly UPA II, when bulk of amount constitute the NPA’s today were given by the banking system during the period 2008-14. From 2014 we have been systematically taking one step after the other to recover these monies back.

3). Prime Minister has given Rs.35000 crores each to two diamond jewellers who have now escaped out of country – factually false.

This banking fraud started in the year 2011 when the UPA II was in power. It was only detected during the NDA period.

4). If the Congress comes to power mobile phones, which are made in China, will now be manufactured in India – a case of inadequate knowledge.

In the year 2014 when UPA went out of power, there were only two mobile phone manufacturing units in India. In 2018, with the result of our electronics policy and the incentives in a four year period, this has increased to 120 units with an investment of Rs.1,32,000 crores.

5). Jobs not being created in India

The latest GDP date has reemphasised India as the fastest growing economy in the world. There is a double digit growth in construction, expansion in manufacturing, an increased capital formation which indicates investment increase, large investment in physical infrastructure and increased investment in rural India. All these are job creating sectors.

6). We will connect farms and villages to the cities – His impression is of the Digvijay Singh era in Madhya Pradesh.

Madhya Pradesh had the worst set of roads in India when the Congress was voted out in 2003. Poor quality roads was one key reason for ousting the Congress. Thanks to Shri Shivraj Singh Chouhan and Prime Minister Modi who during the NDA Government, has tripled the investment in rural roads, in comparison to what the UPA spent, there is a revolution in the Gram Sadak Yojana.

Posted on 26 May, 2018, No Comments Comments admin

The NDA Government led by Prime Minister Narendra Modi has completed four years in office. Today it enters its fifth year in office.

The Change

The preceding ten years of the UPA rule had unquestionably witnessed the most corrupt Government since Independence. Prime Minister Narendra Modi created transparent systems through legislative and institutional changes which have given this country a scam-free governance. Unlike the UPA, the Prime Minister is the natural leader of both his party and the nation. We have witnessed a journey from indecisiveness to clarity and decisiveness. India has transformed from being a part of the “fragile five” to the “bright spot” on the global economic scene. A regime of policy paralysis has been transformed into one of decisions and actions. India, which was on the verge of becoming a “basket case” has today been transformed into the fastest growing major economy in the world and is likely to hold that position in the years to come. The country’s mood from despair has transformed into hope and aspirations. Good governance and good economics have been blended with good politics. The result of this has been that the BJP is more confident, its geographical base has become much bigger, its social base has expanded and its winnability has hugely increased. The Congress is in desperation without the perks of office. From the dominant party of Indian politics, it is moving towards the “fringe”, its political positions are not of a mainstream party but one usually adopted by “fringe” organisations. Fringe organisations can never hope to come in power. Its best hope lies in becoming a supporter of regional political parties. State level regional political parties have realised that the marginalised Congress can at best be either a junior partner or a marginal supporter. Karnataka had witnessed a telling example of this. A regional political party whose base at best is confined to a few districts was able to extract a Chief Ministership of the Congress to which the Congress meekly surrendered. It had even lost its bargaining capacity. It is today putting on a brave face in Karnataka where the losers are masquerading as a winner.

Scam-free Governance

Prime Minister Modi has institutionalised a system where discretions have been eliminated. Discretions lead to abuse of power because they can be misused. Allocations of contracts, natural resources, spectrum and other Government largesse which were being distributed through discretions, are now allocated through a market mechanism. Laws have been changed. Leaders of the industry are no longer seen repeatedly visiting the South Block, the North Block or the Udyog Bhawan. Environmental clearance files don’t pile up. FIPB has been abolished.

For cleaning up the economy, India has to transform from a tax non-compliant society to a tax-compliant society. The enactment and implementation of the Goods and Services Tax, the impact of demonetisation, effective tax compliance are all steps against black money, steps which are formalising the Indian economy. The Insolvency and Bankruptcy Code has changed the lender-creditor relationship. The creditors no longer have to chase the debtors. If you cannot pay your creditors, you have to exit through a statutory mechanism.

The Social Sector Priority

For the first time in history, the poor and the marginalised are holding bank accounts as part of the world’s largest financial inclusion programme. The MUDRA Yojana has made cheaper credit available to the weak and the marginalised. The biggest beneficiaries of this have been women, SC/ST, minorities and other weaker sections. Rural roads with a hugely increased expenditure are a success story. That every village must be connected with road and electricity, affordable rural housing, toilets and gas connections in all homes, are intended to change the quality of life in villages. The Crop Insurance Scheme and the Government’s decision that farmers must get 50 percent above cost are steps intended to eliminating agricultural distress. The UPA Government had sanctioned Rs.40,000 crores under MGNREGA but with budget cuts spent only Rs.29,000 crores. Today that expenditure has been doubled. Under Food Security Programme, the expenditure has been increased to Rs.1,70,000 crores to ensure cheaper food-grain availability to the eligible. On the healthcare front, the destiny of India’s poor will change when 40 percent families at the bottom of the ladder will get a treatment upto rupees five lakhs for hospitalisation at the cost of the Government scheme.

The Economic Management

During the UPA Government, India had fallen off the global radar. In its initial years when the world economy was booming, India grew on the strength of global tailwinds. When the global situation became challenging, the UPA’s decisiveness and performance collapsed. The last two years of the UPA had witnessed substantially lower growth rates. From the very first year of NDA, India is the world’s fastest growing major economy with the highest GDP growth rates. This is also the global projection for the next few years.

The Current Account Deficit (CAD) saw an unprecedented 6.7 percent deficit in the year 2012-13. The NDA has consistently maintained a CAD of under 2 percent on an annualised basis. The poor economic management was visible when under the UPA fiscal deficits remained alarmingly high. The Government was spending more and earning less. We witnessed fiscal deficits of 5.8 percent, 4.8 percent and 4.4 percent in the UPA’s last three years. Having inherited the mess, the NDA, year after year, has brought it down to 3.5 percent and shall, this year, try and deliver a 3.3 percent fiscal deficit. The UPA’s economic management was such that even when fiscal deficits were high, expenditure cuts of over rupees one lakh crores were done in order to make fiscal deficit optically look slightly better. Cut in expenditure means cut in growth. During the NDA years, Revised Estimates of expenditure were always been higher than Budget Estimates. The UPA provided India in its last years an inflation figure upto 9 percent and at one stage even crossed into double digits. The NDA has tried to contain inflation and on most occasions has remained within the target of 3 to 4 percent. The poor economic management of the UPA resulted in the high cost of borrowing for the Centre and the State Governments. The bond yields had touched an incredible 9.12 percent in April, 2014. We have been, on an average, able to contain it between 6 to 7 percent with a low of 6.3 percent on one occasion and rarely in the 7 percent range only when global factors impacted either the currency or the crude prices.

From the last year of the UPA, the infrastructure expenditure to this year has increased by 134 percent during the current year. The Congress President must remember that taxes don’t go into the pocket of the Government. They go back to the people for better infrastructure, better social sector expenditure and poverty reduction programmes. The social sector expenditure has seen a substantial increase by both the Central and the State Governments. The road sector programmes has witnessed a 189 percent increase between the last year of the UPA and the current year of the present Government. Resources are transferred to the States with 42 percent devolution of taxes, Finance Commission grants and assistance through the CSS schemes. Notwithstanding the perpetual grumbling, last year of the UPA witnessed Rs.5,15,302 being transferred to the States. This year the proposed transfer is 145 percent higher and will be at 12,62,935. crores. This is over and above what the States earn from the GST where they have been constitutionally protected with a 14 percent annual increase. The States independently levy their own taxes.

Institutional changes thus being enacted and implemented are putting the Indian economy on a far stronger wicket.

The Fifth Year Debate

As we enter the fifth year of the Government, the NDA’s priorities are clear. This will be our year of consolidation of the policies and programmes which we have implemented. In our Prime Minister, we have a strong leader with a mass appeal. His capacity to change India’s destiny is globally recognised. His insistence on integrity, his infatigable capacity to work, his clarity of policy and direction, his boldness in taking steps in larger national interest gives the NDA a natural political advantage. Clarity and credibility are hallmarks of the NDA Government.

The last few days have witnessed a discussion about a “fictional alternative”. A group of disparate political parties are promising to come together. Some of their leaders are temperamental, the others occasionally change ideological positions. With many of them, such as TMC, DMK, TDP, BSP and the JD(S), the BJP has had an opportunity to share power. They frequently change political positions. They have supported the BJP claiming that it is in larger national interest and then turned turtle and oppose it in the name of secularism. These are ideologically flexible political groups. Stable politics is far from their political track record. Some amongst this disparate group have an extremely dubious track record of governance. Some leaders are maverick and others include those who are either convicted or charged with serious allegations of corruption. There are many whose political support base is confined to either a few districts or to a particular caste. To rule a large country like India through coalitions is possible but the nucleus of a coalition has to be stable. It must have a large size, an ideologically defined position and a vested interest in honest governance. A federal front is a failed idea. It was experimented under Shri Charan Singh, Shri Chandrasekhar and by the United Front Government between 1996-98. Such a front with its contradictions, sooner or later, loses its balance and equilibrium. Remembering 1996-98 as perhaps one of the worst period of governance, the aspirational India which today occupies the high table in the world shall never accept an idea which has repeatedly failed. History teaches us this lesson. Aspirational societies with vibrant democracies do not invite anarchy. A strong nation and the requirements of good governance abhor anarchy. The political agenda for the debate this year appropriately will be Prime Minister “Modi versus an anarchist combination”. The 2014 election conclusively established that in the New India chemistry will score over arithmetic when it comes to deciding the country’s destiny.

Posted on 07 January, 2018, No Comments Comments admin

India is the largest democracy in the world. However, despite strengthening various institutions for the last seven decades, India has not been able to evolve a transparent political funding system. Elections and political parties are a fundamental feature of Parliamentary democracy. Elections cost money. The round the year functioning of the political parties involves a large expenditure. Parties run offices throughout the country. Staff salaries, travelling expenses, establishment cost are regular expenditures of political parties. There has not been a single year where election either for the Parliament or State Assemblies have not been held. Besides expenditure of individual candidates, political parties have to spend money on election campaigns, publicity, tours, travels and election related establishments. These expenditures run into hundreds of crores. Yet there has not been a transparent funding mechanism of the political system.

The conventional system of political funding is to rely on donations. These donations, big or small, come from a range of sources from political workers, sympathisers, small business people and even large industrialists. The conventional practice of funding the political system was to take donations in cash and undertake these expenditures in cash. The sources are anonymous or pseudonymous. The quantum of money was never disclosed. The present system ensures unclean money coming from unidentifiable sources. It is a wholly non-transparent system. Most political groups seem fairly satisfied with the present arrangement and would not mind this status-quo to continue. The effort, therefore, is to run down any alternative system which is devised to cleanse up the political funding mechanism.

A major step was taken during the first NDA Government led by Shri Atal Bihari Vajpayee. The Income Tax Act was amended to include a provision that donations made to political parties would be treated as expenditure and would thus give a tax advantage to the donor. If the political party disclosed its donations in a prescribed manner, it would also not be liable to pay any tax. A political party was expected to file its returns both with the income-tax authorities and Election Commission. It was hoped that donors would increasingly start donating money by cheque. Some donors did start following this practise but most of them were reluctant to disclose the details of the quantum of donation given to a political party. This was because they feared consequences visiting them from political opponents. The law was further amended during the UPA Government to provide for “pass through” electoral trust so that the donors would park their money with the electoral trusts which in turn would distribute the same to various political parties. Both these reforms taken together resulted in only a small fraction of the donations coming in form of cheques.

In order to make a serious effort to carry forward this reform process, I had announced in my Budget Speech for the year 2017-18 that the existing system would be substantially widened and donations of clean money could be made to political parties in several ways. A donor could enjoy a tax deduction by donating in cheque. Donors were also free to donate moneys online to political parties. A cash donation to a political party could not exceed an amount of Rs.2000/-. In addition, a scheme of electoral bonds was announced to enable clean money and substantial transparency being brought into the system of political funding.

I do believe that donations made online or through cheques remain an ideal method of donating to political parties. However, these have not become very popular in India since they involve disclosure of donor’s identity. However, the electoral bond scheme, which I placed before the Parliament a few days ago, envisages total clean money and substantial transparency coming into the system of political funding. A donor can purchase electoral bonds from a specified bank only by a banking instrument. He would have to disclose in his accounts the amount of political bonds that he has purchased. The life of the bond would be only 15 days. A bond can only be encashed in a pre-declared account of a political party. Every political party in its returns will have to disclose the amount of donations it has received through electoral bonds to the Election Commission. The entire transactions would be through banking instruments. As against a total non-transparency in the present system of cash donations where the donor, the donee, the quantum of donations and the nature of expenditure are all undisclosed, some element of transparency would be introduced in as much as all donors declare in their accounts the amount of bonds that they have purchased and all parties declare the quantum of bonds that they have received. How much each donor has distributed to a political party would be known only to the donor. This is necessary because once this disclosure is made, past experience has shown, donors would not find the scheme attractive and would go back to the less-desirable option of donating by cash. In fact the choice has now to be consciously made between the existing system of substantial cash donations which involves total unclean money and is non-transparent and the new scheme which gives the option to the donors to donate through entirely a transparent method of cheque, online transaction or through electoral bonds. While all three methods involve clean money, the first two are totally transparent and the electoral bonds scheme is a substantial improvement in transparency over the present system of no-transparency.

The Government is willing to consider all suggestions to further strengthen the cleansing of political funding in India. It has to be borne in mind that impractical suggestions will not improve the cash denominated system. They would only consolidate it.

Posted on 09 December, 2017, No Comments Comments admin

Having been an active participant in the Gujarat Assembly elections since 2002, I cannot resist the temptation of analysing the Congress campaign 2017.

The first distinct aspect of Congress Party’s campaign is that it has clearly demolished its own State-level leadership and outsourced both its leadership and issues to those who had conventionally nothing to do with the Congress Party. There is not a single State leader who is touring the State for the campaign. The Party has disconnected the traditional issues on which it has been campaigning since 2002 and opted for a divisive agenda of social repolarisation. The State paid a heavy price for such mis-adventures in the 1980s and would be very reluctant to repeat this experiment after having liberated itself from caste wars.

The second limb of the Congress campaign has been that the Gujarat model of development does not exist. This claim has been conclusively demolished by the recent data that Gujarat is the only State in India whose GSDP grew by 10 percent during the period 2012-2017. Gujarat grew atleast two percent faster than the nearest growing State i.e. Madhya Pradesh. A double digit growth rate is unheard during the period of economic downturn. Even the Chinese new normal during this period has been 6.5 percent. A seven percent plus growth rate made India the fastest growing among the major economies for three years. For a large State to grow at 10 percent is unprecedented. The fact that this growth rate has been sustained for five years in a row is an evidence of the success of the Gujarat model, which the Congress wants to wish away.

The next important limp of the Congress campaign is a promise of reservations over and above 49 percent. The Supreme Court, since 1992, has repeatedly reemphasised that the net total of all reservations cannot exceed 50 percent. States which have attempted to breach this cap have faced constitutional resistance. A promise of reservations beyond 50 percent has been made by the Congress and the PAAS to the people of Gujarat. This act of self-deception is a constitutional impossibility – which will never be judicially permissible.

Having no model of development, the Congress Party manifesto is one of fiscal impossibility. The total revenue earned by the State is about Rs.90,000 crores per annum. The Congress promises a tax waiver of Rs.20,000 crores. This will bring down the effective revenue income of State to Rs.70,000 crores. To this may be added the Central devolution and the borrowings which under the FRBM Act have a three percent cap. All these constitute the committed liabilities of salaries, pensions, social and developmental expenditure. There is no surplus money left after this committed expenditure. The Congress manifesto promises an additional bonanza of Rs.1,21,000 crores in terms of populist programmes. It doubles the expenditure while reducing the income, which is a fiscal nightmare. Even a fiscal miracle does not permit this. The two important limbs of the Congress manifesto comprise of one – a constitutional impossibility and the other – a fiscal impossibility. The Congress Party can well afford this risk since its victory is a political improbability.

Posted on 28 November, 2017, No Comments Comments admin

Over the last few days, a rumour is being propagated regarding waiver of loans of capitalists by banks. Time has come for the nation to be apprised of facts in this regard.

Between the years 2008 to 2014, Public Sector Banks disbursed disproportionate sums of loans to several industries. The public needs to ask the rumour mongers at whose behest or under whose pressure were such loans disbursed. They should also be asked that when these debtors delayed in repayment of their loans and interest thereon to Public Sector Banks, what decision was taken by the then Government.

Rather than take firm decision with regard to such debtors, the then Government, through relaxation by banks in loan classification kept these defaulters as non-NPA accountholders. These loans were restructured through this, the loss to banks was kept hidden. The banks kept giving loans repeatedly to these debtors and kept ever-greening the loans.

The current Government recognised this nexus and took firm decisions with regard to the defaulters. Insolvency and Bankruptcy Code was enacted, and by amending it, in respect of companies whose money was not returned to the banks, decision was taken that the debtors concerned would not be allowed to participate in the business of such companies.

At the same time, banks were given necessary capital so that Public Sector Banks become strong and capable of contributing to nation’s development. The reason for giving capital to banks is that these banks may become mazboot, i.e., strong, rather than mazboor, i.e., hard-pressed. Public Sector Banks have been provided capital in the past as well. During 2010-11 to 2013-14 too, Government provided banks an amount of Rs. 44,000 crore for recapitalisation. Was that also for waiving loans of capitalists?

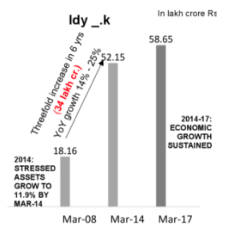

Legacy of aggressive lending:

During the period of aggressive lending from 2008 to 2014, the gross advances of Public Sector Banks increased from about Rs. 34,00,000 crore. Despite repayment not being regular on these, through relaxation in loan classification, banks continued to keep defaulters as non-NPA accountholders by restructuring them. Through this, the losses of banks and their precarious position was kept under the carpet.

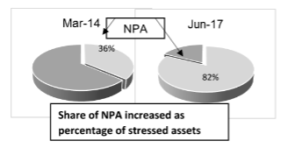

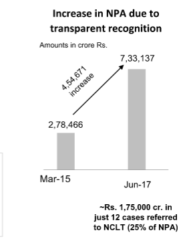

Transparent and realistic recognition of NPA:

Asset Quality Review carried out for clean and fully provisioned balance-sheets in 2015 revealed high NPA. Through correct recognition of NPA, the NPA amount of Public Sector Banks rose from Rs. 2,78,000 crore in March 2015 to Rs. 7,33,000 crore in June 2017. Meaning thereby that those loans, of about Rs. 4,54,466 crore, which were actually fit to be NPA and were under the carpet, were recognised after intensive scrutiny under Asset Quality Review.

Provision for expected losses:

In the past, adequate provision was not made for expected losses from stressed loans under the relaxation available for restructured loans. Public Sector Banks initiated clean-up and NPA recognition, and made up-front provision for expected loss. Government envisage need of capital to the tune of Rs. 1,80,000 crore till FY 2018-19. Accordingly, Government provided for Rs. 70,000 crore. As a result of Indradhanush despite high NPA and the need for consequential provisioning, Public Sector Banks were successful in complying with Basel III norms. Between 2013-14 and the first quarter of FY 2017-18, provision of Rs. 3,79,080 crore was made to deal with expected losses, as against provision of Rs. 1,96,937 crore made in the preceding 10 years.

No loan waiver:

Government has not waived any loans of big NPA defaulters as aforesaid. On the contrary, under the new Insolvency and Bankruptcy Code brought by the Government, cases have been instituted in the National Company Law Tribunal (NCLT) for timebound recovery from 12 largest defaulters in six to nine months, in NPA cases of Rs. 1,75,000 crore. Cases for the recovery of NPA dues from the assets of these big defaulters are under way at various stages.

Bar on wilful defaulters:

To safeguard misuse of the legal process by unscrupulous and undesirable persons, this week, through an ordinance, Government has barred wilful defaulters and persons associated with NPA accounts from participating in the process under way in NCLT. Through these steps, for the first time in the country, Government has put in place a clean and effective system through which wilful defaulters of bank loans may be kept away from the management of their business and timebound recovery effected from them.

Unprecedented capitalisation of Public Sector Banks:

With the object of increase credit off-take and creation of jobs, Government has taken the big decision of capitalising Public Sector Banks. Under this, with maximum allotment in the current year, capital increase of Rs. 2,11,000 crore would be effected within two financial years. This would be arranged through Rs. 1,35,000 crore of recapitalisation bonds, Rs. 18,139 crore of budget provision, with the balance coming from raising of capital from the market (estimated potential Rs. 58,000 crore) by diluting Government shareholding. Through capital infusion, banks weakened by NPAs would become strong and become capable of raising adequate capital from the market. For receiving this capital, banks will have to carry out several reforms, so that such situations do not recur.

Loans to honest businesspersons:

Through these strong steps taken over the last three years, not only have the problems received as legacy been addressed but reforms for rebuilding the strength of Public Sector Banks have been boosted. The process of creation of strong and large banks began with the integration of State Bank of India, and the recapitalisation announced will bolster this process. While honest businesspersons will be able to access loans from strong and reformed banks, strict and clear law and the all-round clean-up initiated by the Government would result in a clean system in the country.

Posted on 07 November, 2017, No Comments Comments admin

November 8, 2016 would be remembered as a watershed moment in the history of Indian economy. This day signifies the resolve of this Government to cure the country from “dreaded disease of black money”. We, the Indians, were forced to live with this attitude of “chalta hai” with respect to corruption and black money and the brunt of this attitude was faced particularly by the middle class and lower strata of society. It was a hidden urge of the larger section of our society for a long period to root out the curse of corruption and black money; and it was this urge which manifested in the verdict of people in May 2014.

Immediately after taking up responsibility in May 2014, this Government decided to fulfil the wish of the people in tackling the menace of black money by constituting SIT on black money. Our country is aware that how even a direction from the Supreme Court on this issue was ignored by the then Government for number of years. Another example of lack of will to fight against black money was the delay of 28 years in implementation of Benami Property Act.

This Government took decisions and implemented the earlier provisions of law in a well-considered and planned manner over three years to meet the objective of fight against black money. These decisions span from setting up of SIT to passing of necessary laws for foreign assets to demonetisation and to implementation of GST.

When the country is participating in “Anti-Black Money Day”, a debate was started that whether the entire exercise of demonetisation has served any intended purpose. This narrative attempts to bring out positive outcomes of demonetization in short-term and medium-term with respect to stated objectives.

RBI has reported in their Annual Accounts that Specified Bank Notes (SBNs) of estimated value of Rs.15.28 lakh crore have been deposited back as on 30.6.2017. The outstanding SBNs as on 8th November, 2016 were of Rs.15.44 lakh crore value. The total currency in circulation of all denominations as on 8th November, 2016 was 17.77 lakh crore.

One of the important objective of demonetisation was to make India a less cash economy and thereby reduce the flow of black money in the system. The reduction in currency in circulation from the base scenario reflects that this intended objective has been met. The published figure of “currency in circulation” for half year ending September, 2017 is Rs.15.89 lakh crore. This shows year on year variation of (-) Rs.1.39 lakh crore; whereas year on year variation for the same period during last year was (+) Rs.2.50 lakh crore. This means that reduction in currency in circulation is of the order of Rs.3.89 lakh crore.

Why should we remove excess currency from the system? Why should we curtail cash transactions? It is common knowledge that cash is anonymous. When demonetization was implemented, one of the intended objectives was to put identity on the cash holdings in the economy. With the return of Rs.15.28 lakh crore in the formal banking system, almost entire cash holding of the economy now has an address. It is no more anonymous. From this inflow, the amount involving suspicious transactions based on various estimates ranges from Rs.1.6 lakh crore to Rs.1.7 lakh crore. Now it is with the tax administration and other enforcement agencies to use big data analytics and crack down on suspicious transactions.

Steps in this direction have already started. Number of Suspicious Transaction Reports filed by banks during 2016-17 has gone up from 61,361 in 2015-16 to 3,61,214; the increase during the same period for Financial Institutions is from 40,333 to 94,836 and for intermediaries registered with SEBI the increase is from 4,579 to 16,953.

Based on big data analytics, cash seizure by Income Tax Department has more than doubled in 2016-17 when compared to 2015-16; during search and seizure by the Department Rs.15,497 crore of undisclosed income has been admitted which is 38% higher than the undisclosed amount admitted during 2015-16; and undisclosed income detected during surveys in 2016-17 is Rs.13,716 crore which is 41% higher than the detection made in 2015-16.

Undisclosed income admitted and undisclosed income detected taken together amounts to Rs.29,213 crore; which is close to 18% of the amount involved in suspicious transactions. This process will gain momentum under “Operation Clean Money” launched on January 31, 2017.

The exercise to remove the anonymity with currency has further yielded results in the form of

- 56 lakh new individual tax payers filing their returns till August 5, 2017 which was the last date for filing return for this category; last year this number was about 22 lakh;

- Self-Assessment Tax (voluntary payment by tax payers at the time of filing return) paid by non-corporate tax payers increasing by 34.25% during April 1 to August 5 in 2017 when compared to the same period in 2016.

With increase in tax base and bringing back undisclosed income into the formal economy, the amount of Advance Tax paid by non-corporate tax payers during the current year has also increased by about 42% during 1st April to 5th August.

The leads gathered due to data collected during demonetisation period have led to identification of 2.97 lakh suspect shell companies. After issuance of statutory notices to these companies and following due process under the law, 2.24 lakh companies have been de-registered from the books of Registrar of Companies.

Further actions were taken under the law to stop operation of bank accounts of these struck off companies. Actions are also being taken for freezing their bank accounts and debarring their directors from being on board of any company. In the initial analysis of bank accounts of such companies following information has come out which are worth mentioning:

- Of 2.97 lakh struck off companies, information pertaining to 28,088 companies involving 49,910 bank accounts show that these companies have deposited and withdrawn Rs.10,200 crore from 9th November 2016 till the date of strike off from RoC;

- Many of these companies are found to have more than 100 bank accounts – one company even reaching a figure of 2,134 accounts;

Simultaneously, Income Tax Department has taken action against more than 1150 shell companies which were used as conduits by over 22,000 beneficiaries to launder more than Rs.13,300 crore.

Post demonetization, SEBI has introduced a Graded Surveillance Measure in stock exchanges. This measure has been introduced in over 800 securities by the exchanges. Inactive and suspended companies many a time are used as harbours of manipulative minds. In order to ensure that such suspicious companies do not languish in the exchanges, over 450 such companies have been delisted and demat accounts of their promoters have been frozen; they have also been barred to be directors of listed companies. Around 800 companies listed on erstwhile regional exchanges are not traceable and a process has been initiated to declare them as vanishing companies.

Demonetization appears to have led to an acceleration in the financialisation of savings. In parallel, there is a shift towards greater formalisation of the economy in the near term aided by the introduction of Good and Services Tax (GST). Some of the parameters indicating such shift are given below:

- Corporate bond market has started reaping the benefits of additional financial savings and transmission of interest rate reduction. The corporate Bond market issuance grew to Rs. 1.78 lakh crore in 2016-17, the year on year increase was Rs.78,000 crore. With other sources of issuance in capital market the incremental variation is almost Rs.2 lakh crore in 2016-17 while that was Rs.1 lakh crore in 2015-16.

- This trend is further substantiated by the surge in primary market raising through public and rights issues. There were 87 issues of public and rights for raising equity involving amount of Rs.24,054 crore during FY 2015-16; in the first six months of 2017-18 itself there are 99 such issues amounting to Rs.28,319 crore.

- Net inflow into Mutual Funds during 2016-17 increased by 155% during 2016-17 over 2015-16 reaching 3.43 lakh crore; Net inflows in mutual funds during November 2016 to June 2017 was about Rs.1.7 lakh crore as against Rs.9,160 crore during the same period in the year before;

- Premia collected by life insurance companies more than doubled in November 2016; the cumulative collections during November 2016 to January 2017 increased by 46 per cent over the same period of the previous year. The premium collections witnessed 21% growth for year ending September 2017 over the corresponding period of previous year.

With a shift to less cash economy, India has taken a big leap in digital payment during 2016-17. Some of the trends are given below:

- 110 crore transactions, valued at around Rs.3.3 lakh crore and another 240 crore transactions, valued at Rs.3.3 lakh crore were carried out through credit cards and debit cards, respectively. The value of transaction for debit and credit card was Rs.1.6 lakh crore and Rs.2.4 lakh crore respectively during 2015-16.

- Total value of transaction with Pre-Paid instruments (PPIs) have increased from Rs.48,800 crore in 2015-16 to Rs.83,800 crore in 2016-17. Total volume of transactions through PPIs have increased from about 75 crore to 196 crore.

- During 2016-17, National Electronic Funds Transfer (NEFT) handled 160 crore transactions valued at Rs.120 lakh crore, up from around 130 crore transactions for Rs.83 lakh crore in the previous year.

With higher level of formalisation, it has brought out related benefits to workers who were denied of social security benefits in the form of EPF contribution, subscription to ESIC facilities and payments of wages in their bank accounts. Large increase in opening of bank accounts for workers, enrolment in EPF and ESIC are added benefits of demonetisation. More than 1 crore workers were added to EPF and ESIC system post-demonetisation which was almost 30% of existing beneficiaries. Bank accounts were opened for about 50 lakh workers to get their wages credited in their accounts. Necessary amendment in Payment of Wages Act was done to facilitate this.

The reduction in incidences of stone pelting, protests in J&K and naxal activities in LWE affected districts are also attributed to the impact of demonetisation as these miscreants have run out of cash. Their access to Fake Indian Currency Note (FICN) was also restricted. During 2016-17, the detection of FICN for Rs.1000 denomination increased from 1.43 lakh pieces to 2.56 lakh pieces. At the Reserve Bank’s currency verification and processing system, during 2015-16, there were 2.4 pieces of FICNs of Rs.500 denomination and 5.8 pieces of FICNs of Rs.1000 denomination for every million pieces notes processed; which rose to 5.5 pieces and 12.4 pieces, respectively, during the post-demonetisation period. This shows almost doubling of such detection.

In an overall analysis, it would not be wrong to say that country has moved on to a much cleaner, transparent and honest financial system. Benefits of these may not yet be visible to some people. The next generation will view post November, 2016 national economic development with a great sense of pride as it has provided them a fair and honest system to live in.

Posted on 01 July, 2017, No Comments Comments admin

It has become customary for the critics of any Government in India to casually use an expression “Undeclared Emergency”. Those making these exaggerated comments need to introspect their own roles during the Emergency. Most of them were either supporting the Emergency or were absent in any protest against the Emergency.

Emergency was an assault on all democratic institutions. It not only established the dictatorship of an individual, it created an environment of tyranny and fear in the society. Most institutions collapsed on their own. The Emergency was declared on the midnight of 25th – 26th June, 1975. The ostensible and the official reason was a threat to public order but obviously this was a phoney reasoning. The real reason was that Mrs. Indira Gandhi had been unseated in an election petition by the Allahabad High Court and the Supreme Court had granted only a conditional stay of the High Court order. She wanted to continue in power and resorted to imposition of Emergency to enable this to happen. It would be in the fitness of things to remind those who loosely use a phrase “Undeclared Emergency” with what happened during that period.

The first Act after the imposition of the Emergency was the detention of the political opposition under the Preventive Detention Law. District Magistrates and Collectors were handed over blank detention forms to enable them detain thousands of leaders and workers of the political opposition. Just the name, father’s name and address of each detainee was filled in hand. No grounds of detention existed in any case. Police stations were advised to register identical FIRs arresting ordinary political workers under the Defence of India Rules after alleging that they were either members of banned organisation or were threatening to overthrow the Government. Nine High Courts in the country held that the detention order were justiciable and in the absence of the grounds of detention the same could be quashed. The Supreme Court decided otherwise.

In preparation for the Emergency, the Supreme Court had already been packed with pliable judges. Three seniormost judges of the Supreme Court were superseded and those believing in the social philosophy of the Government were in control of the court. The Supreme Court held that an illegally detained detainee had no judicial recourse during the Emergency. Justice H.R. Khanna was the only dissenting judge. Pre-censorship was imposed on the entire news media. Not a word could be published in the newspaper without going through the censor. An officer of the censor stayed in the premises of every major newspaper. The entire activities of the opposition were blacked out and the media contained only governmental propaganda. Many of those who now complain of an “Undeclared Emergency” were either active or reluctant supporters of the emergency regime.

Both the Constitution of India and the provisions of the Representation of the People Act were retrospectively amended so that each ground on which Mrs. Indira Gandhi’s election had been set aside could be statutorily reversed. The pliable Supreme Court upheld the retrospective amendments to the provision of the Representation of the People Act by upholding the power of Parliament to amend any law retrospectively. The opposition members of both the Houses of Parliament stood detained. The numerical strength of Parliament was reduced. This gave to the Government an opportunity to amend the Constitution through a procured two-third majority in Parliament. A Parliament elected for a period of five years extended its own life beyond five years by amending the Constitution. Opposition Governments in some States were dismissed and India witnessed virtually a single individual rule. All ingredients of an absolute dictatorship existed. There was no personal liberty, no press freedom, the Parliament became a farce, the highest Court became subservient to the dictatorship and there was no room for dissent. This now was an ideal opportunity for the dictator to perpetuate her family and, therefore, the younger son of the Prime Minister, Mr. Sanjay Gandhi, was proclaimed as the de facto successor. The country witnessed forced sterilization, mass scale uprooting of the poor including the minorities from their homes and misuse of the mass media.

An era of sycophancy always suffers from a dichotomy. A dictatorial regime is often misled by its own propaganda. It becomes consumer of its own propaganda with nobody else believing it. It misled itself to believe that the people were in support of the dictatorship. It, therefore, committed the ultimate error of ordering an election which witnessed a rebellion against the Emergency regime.

Today I wonder if those who routinely use the expression “Undeclared Emergency” introspect and ask themselves a question “where was I during those nineteen months and what was my publicly declared stand at that time?”

Posted on 14 March, 2017, No Comments Comments admin

The Congress Party complains a bit too much. It accused the Bharatiya Janata Party (BJP) of ‘stealing’ the mandate in Goa. It unsuccessfully petitioned before the Supreme Court. It attempted to raise issues in the Lok Sabha. What are the facts?

The Assembly Elections in Goa produced an inconclusive verdict. There was a Hung Assembly. Obviously in a Hung Assembly post-poll alliances will be formed. The BJP managed to form an alliance and presented to the Governor 21 out of 40 MLAs. They appeared before the Governor in person and submitted a letter of support. The Congress did not even submit a claim to the Governor. It had only the support of 17 MLAs. The Congress Party protested at the Governor’s decision to invite Mr Manohar Parrikar to form the Government with support of 21 out of 40 MLAs and described it as ‘a murder of democracy’.

In the face of claim of these 21 MLAs led by Mr Manohar Parrikar, the Governor could not have invited the minority of 17 MLAs to form the Government. There are several precedents which support this decision of the Governor.

• In 2005, BJP won 30 out of 81 seats in Jharkhand. The JMM leader Shri Shibu Soren with a support of 17 MLAs of his Party plus others was invited to form the Government .

• In J&K 2002, the National Conference won 28 MLAs but the Governor invited the PDP & Congress Combination of 15 + 21 MLAs to form the Government.

• In 2013 the BJP won 31 seats in Delhi, but the AAP with 28 MLAs with support of Congress was invited to form the Government.

There are other precedents on the same lines available in 1952 (Madras), 1967 (Rajasthan) and 1982 (Haryana).

The debate between the largest single party lacking majority versus a combination of parties constituting a majority was answered by the former President Shri KR Narayanan in his communiqué in March, 1988 when he invited Shri Atal Behari Vajpayee to form the Government. The President had said “when no party or pre-election alliance of parties is in a clear majority, the Head of State has in India or elsewhere, given the first opportunity to the leader of the party or combination of parties that has won largest number of seats subject to the Prime Ministers so appointed obtaining majority support on the floor of the house within a stipulated time. This procedure is not, however, all time formula because situations can arise where MPs not belonging to the single largest party or combination can, as a collective entity, out-number the single largest claimant. The President’s choice of Prime Minister is pivoted on the would be Prime Minister’s claim of commanding majority support.”

The Governor in Goa had only one claim of 21 MLAs out of 40 elected MLAs with Shri Manohar Parrikar as their leader. The 17 MLAs of Congress did not even make a claim nor elected their leader. How could the Congress ever be invited to form the Government?